Summer season 2024: What are the booking forecasts?

Positive signals from South Tyrol and Bavaria, while Tyrol faces challenges.

The summer season in alpine holiday hotels has begun, but how have the booking forecasts developed so far? Demand in South Tyrol and Bavaria is developing positively, while Tyrol is facing challenges and shows a need for improvement. The recent increase in price enforcement is also viewed with mixed feelings. This is all revealed in the current fact-check by Kohl > Partner and RateBoard.

Thomas Steiner, Managing Partner of

Kohl > Partner, has conducted a fact-check on the current

summer season 2024 in collaboration with RateBoard, a renowned provider of revenue management systems in the Alpine region. In this analysis,

400 hotel establishments in the Alpine region were examined. For the first time, a specific distinction was made between the destinations of Tyrol, South Tyrol, and Bavaria.

The following questions were addressed:

- How have demand and price enforcement in holiday hotels in the Alpine region developed so far in the summer of 2024?

- What differences are there compared to the previous year?

- What differences are evident specifically in the destinations of Tyrol, South Tyrol, and Bavaria?

- What insights can be derived from this?

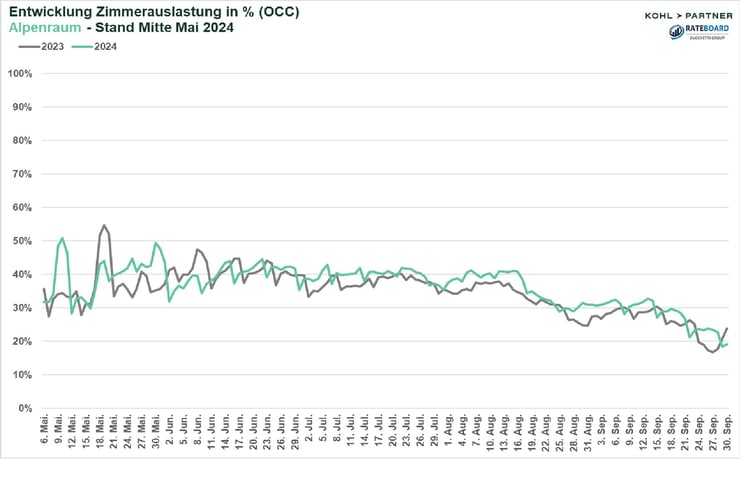

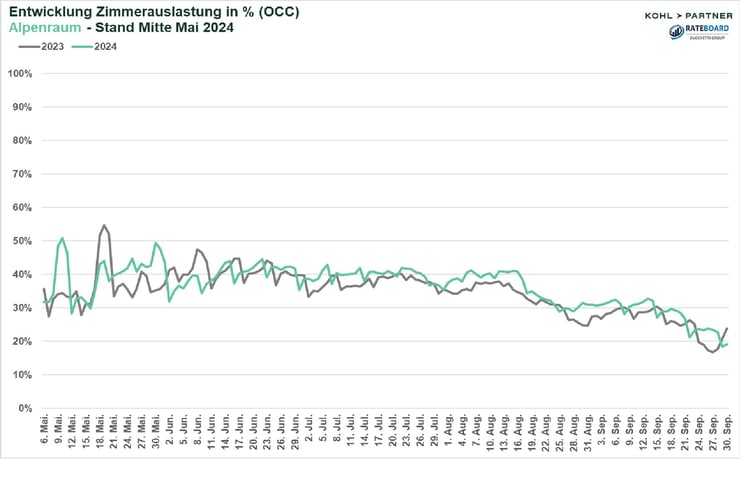

Occupancy Development – Alpine Region:

The booking forecasts for hotel establishments in the Alpine region so far indicate a slight increase in occupancy of an average of 2% for the summer of 2024 compared to the previous year. In May, there is currently a year-over-year increase of +3%, primarily attributed to the holidays. Despite the absence of the Whitsun holidays and the Corpus Christi holiday in June 2024, the occupancy of holiday hotels in the Alpine region remains nearly stable with a slight decrease of -1% so far. For the main holiday months of July and August, the forecast shows an average increase of 2.6%. Additionally, an increase in occupancy of +2.1% is expected for the autumn.

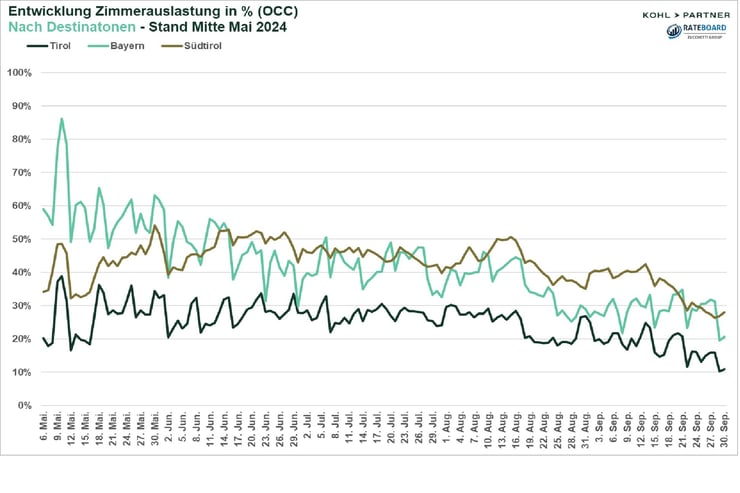

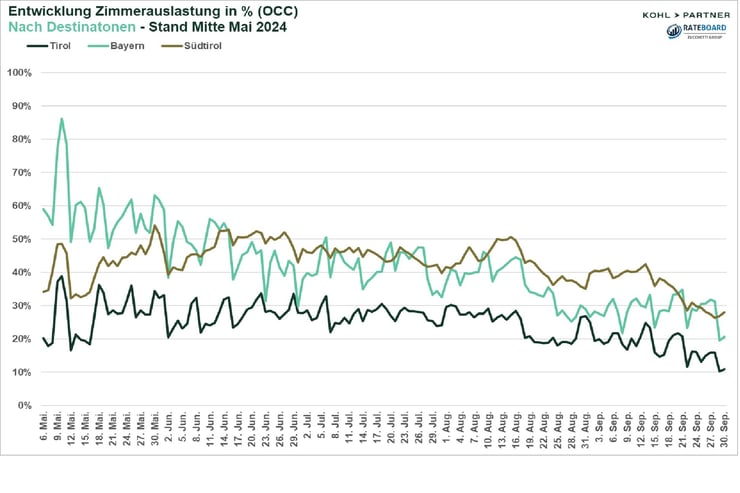

The analysis of the booking forecast for holiday hotels in the destinations of South Tyrol, Tyrol, and Bavaria presents a differentiated picture:

Occupancy Development – Destinations:

In May 2024, the current booking forecast for Bavarian holiday hotels exceeds the level of South Tyrol by 25% and is significantly higher than Tyrol by 33%. The holidays in May, in particular, show better occupancy in Bavaria compared to the other destinations. In June and July, South Tyrol leads the forecast, slightly surpassing Bavaria with an increase of 3%. In the holiday month of August and into the autumn, the gap between South Tyrol and Bavaria, and especially Tyrol, becomes even larger. According to the booking forecasts, Tyrol currently shows the lowest demand.

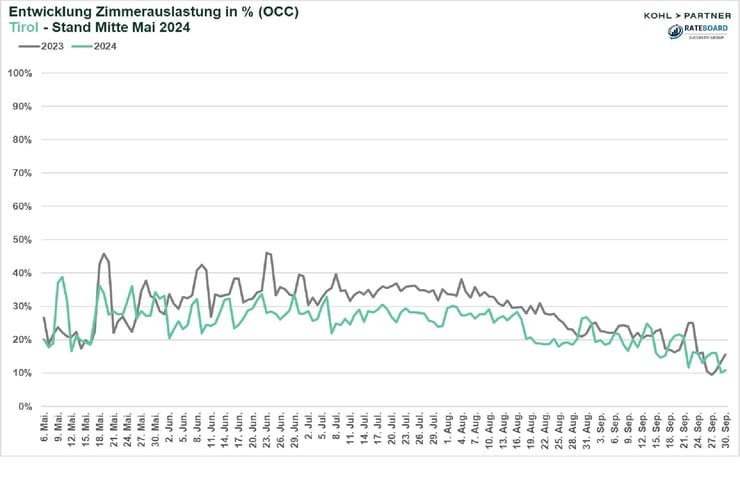

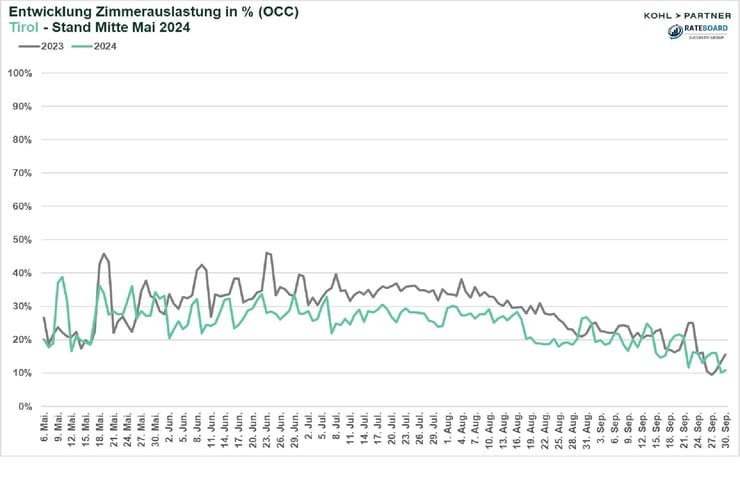

Occupancy Development - Tyrol:

The booking forecasts for hotel establishments in Tyrol show predominantly declining demand for the summer of 2024 so far. In May, occupancy sees a slight increase of only +0.3%, nearly maintaining the level of the previous year. However, there is a clear need for catch-up in the months of June and July, with bookings decreasing by -7.4% compared to the previous year. The holiday month of August also records a lower demand with a decrease of 5.2% compared to the previous year. This trend partially continues into September, with occupancy being 1.8% below the previous year's level.

Occupancy Development - South Tyrol:

The booking forecast for South Tyrol shows a positive trend for the summer of 2024 so far. Bookings in May are up by +2.1% compared to the previous year, primarily attributed to the early holidays. Despite the absence of holidays in June, the decrease so far has been minimal, with a slight decline of 0.4% compared to the previous year. An average increase of +3.1% is recorded in the classic holiday months. The month of September shows the strongest growth in the forecast, with an increase of +4.7% compared to the other summer months.

Occupancy Development - Bavaria:

The booking forecast in Bavarian holiday hotels shows a similarly positive trend compared to the previous year, similar to South Tyrol. May exhibits the strongest increase in bookings, influenced notably by holidays, with a rise of +4.6%. In June, the booking forecast is slightly below the previous year's level with a slight decline of 1.3%. However, for the months of July through September, there is currently an increase of +3% compared to the previous year.

Of particular note is the higher variability between weekday and weekend bookings in Bavaria compared to South Tyrol, where a more stable baseline occupancy is observed. This could suggest that South Tyrol experiences a more even distribution of tourist flows throughout the week, whereas in Bavaria, demand is particularly concentrated on weekends.

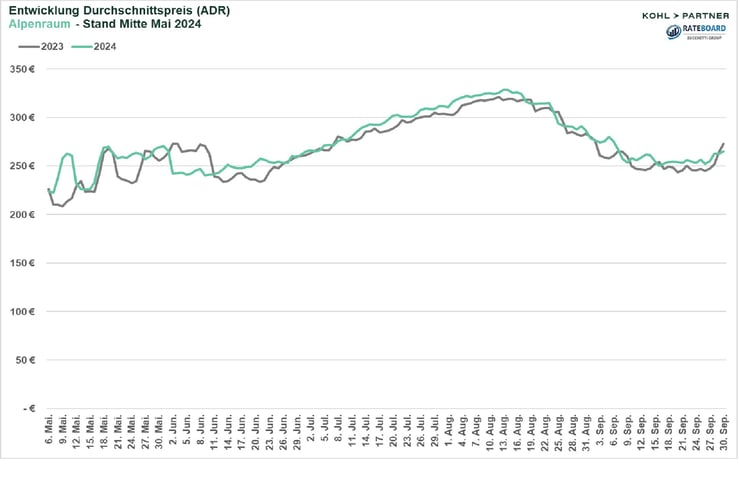

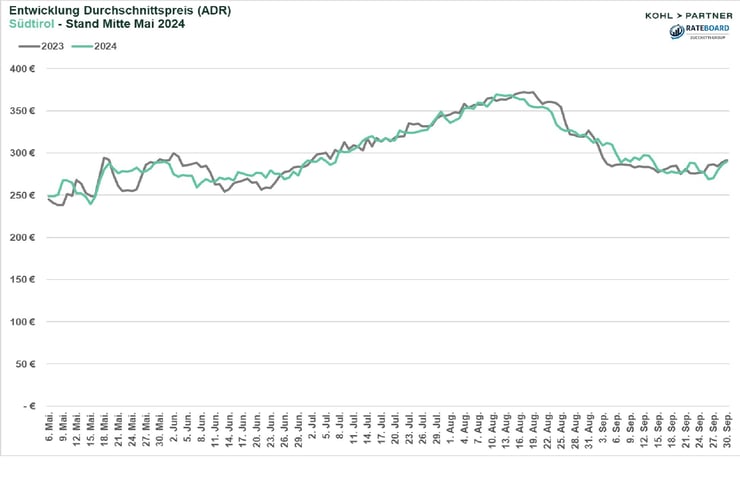

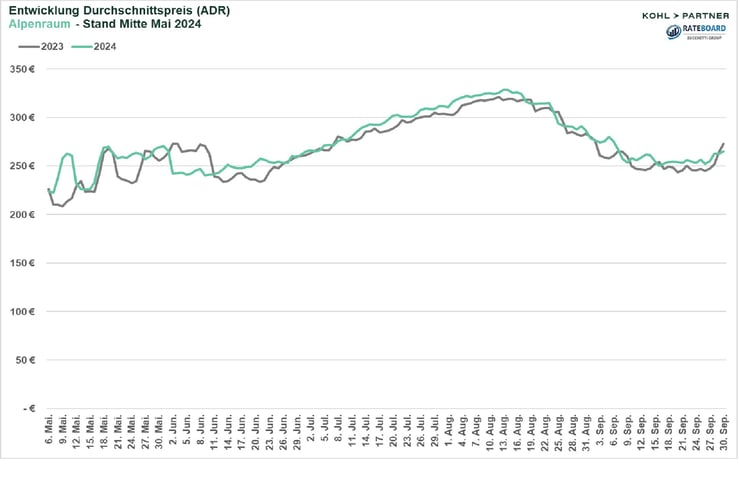

Average Price Development - Alpine Region:

In the summer of 2024, the average room rates have shown a slight increase in price enforcement by an average of 2% compared to the previous year. Hoteliers are particularly bold in May: around the holiday periods, there is a notable increase in room rates of nearly 6% compared to the previous year. However, in June, the room rates reflect the previous year's level, which is also reflected in the occupancy rates so far. In the peak season months of July and August, as well as in September, there is an observed increase in price enforcement by +2% each.

When examining the average price enforcement in the individual summer months, there is a distinctly different sentiment observed when considering the destinations of Tyrol and South Tyrol:

Average Price Development – Destinations:

So far, hotel establishments in South Tyrol are offering the highest room rates throughout the entire summer season compared to other destinations. The most significant difference between South Tyrol and Tyrol (33%) as well as Bavaria (25%) is notably observed in August. Price enforcement in Bavaria is significantly higher than that in Tyrol in May and September, while the average room rates in June and August are at a similar level.

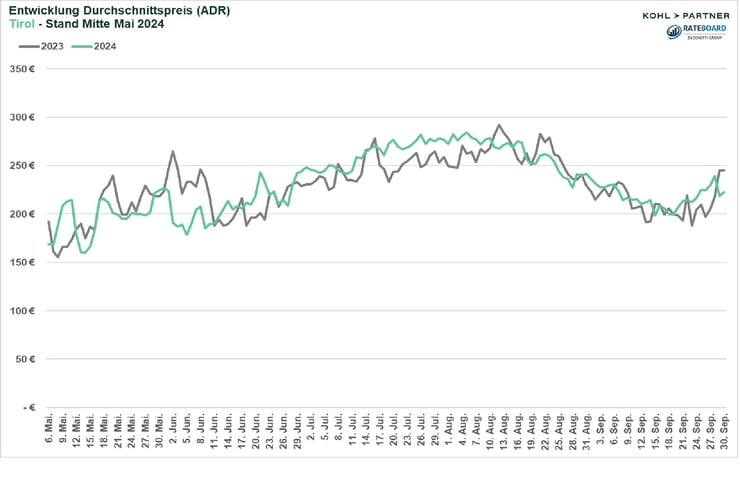

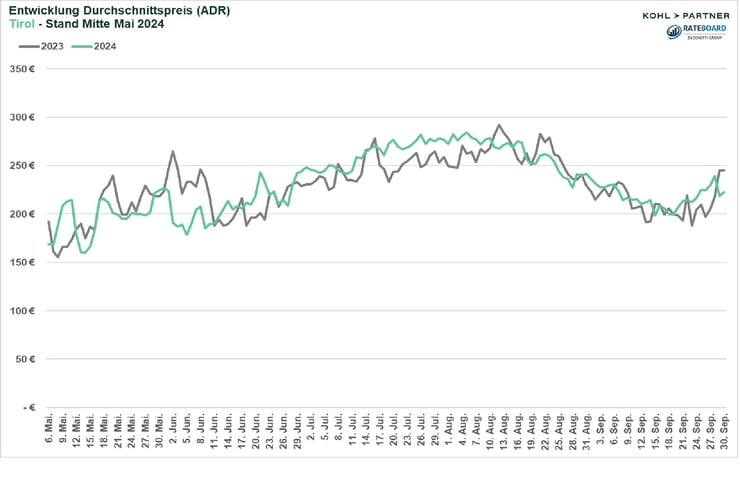

Average Price Development - Tyrol:

The current development of average room rates in the Tyrolean holiday hotel industry for the summer of 2024 shows significant fluctuations compared to the previous year. In May and June, price enforcement is down by -1.6% and -3.5% respectively compared to the previous year. In contrast, despite a previously declining demand, July sees a significant increase in room rates by +5.9%. In August, the price enforcement corresponds to the previous year's level, while there is an increase of nearly 3% observed in September.

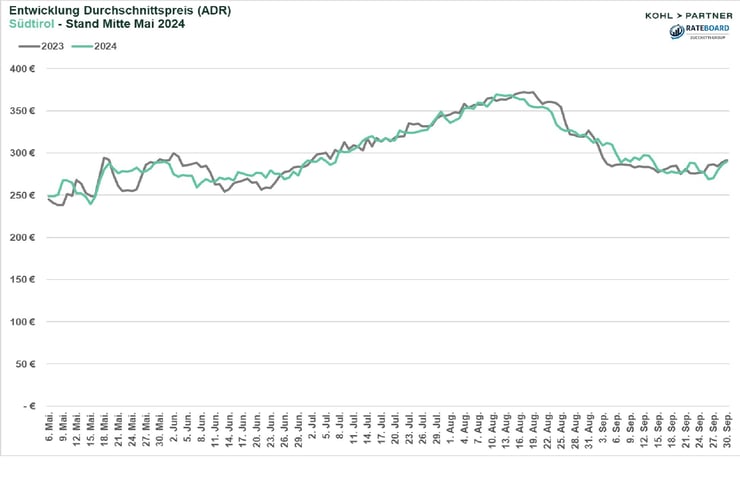

Average Price Development - South Tyrol:

Although the occupancy in South Tyrol is forecasted to develop positively, the average room rate has shown little change so far, with a minimal increase of 0.2%, nearly maintaining the level of the previous year. Significant growth in price enforcement is scarcely observable in the individual months.

This could be attributed to the following factors:

- Lack of confidence in pricing due to the significant price increases in recent years and the price sensitivity of guests.

- Increased use of early booking offers to boost booking numbers, especially given the moderate demand in the summer of 2023.

- Guests' preference for more affordable room categories and types of accommodation.

In summary, the following insights can be derived from the summer of 2024 so far:

- Booking forecasts for the summer of 2024 in the Alpine region show a slight increase compared to the previous year:

Booking forecasts for hotel establishments in the Alpine region for the summer of 2024 tend to surpass the levels of the previous year, driven by an increase in May, primarily attributed to holidays. Despite a slight decline in June due to the absence of Pentecost holidays and Corpus Christi, a continuation of the positive trend is expected for the main holiday months of July and August, as well as for the autumn.

- Price enforcement has seen only a slight increase:

Hoteliers exhibit confidence in pricing only around the holidays in May, with a significant increase in room rates compared to the previous year. Room rates remain at the previous year's level in June, reflecting in the occupancy rates as well. A slight increase in price enforcement is observed in the peak season months of July and August, as well as in September.

- Significant differences in booking forecasts between individual destinations are noticeable:

South Tyrol records the highest demand in the current summer, followed by Bavaria, while Tyrol shows a significant need for improvement.

South Tyrol experiences a positive booking trend with increases in May, a slight decline in June, and significant growth in the main holiday months as well as in September compared to the previous year. Conversely, Tyrol experiences predominantly declining demand, with minimal increases in May and significant declines in the following months. Bavaria shows a similarly positive trend to South Tyrol, with the most significant increase in May and a continuous improvement from July to September.

- Significant differences in room rates are also noticeable:

Room rates in Tyrolean holiday hotels for the summer of 2024 fluctuate significantly compared to the previous year. While declines are observed in May and June, there is a significant increase in July despite declining demand. Room rates remain stable in August, with a slight increase observed in September. In South Tyrol, however, despite positive occupancy development, the average room rate remains nearly unchanged compared to the previous year, with minimal notable increases in prices. So far in the summer of 2024, hotels in South Tyrol offer the highest room prices, followed by Bavaria and Tyrol.

Hotel expert Thomas Steiner, Managing Partner at Kohl > Partner, concludes: "There are clear differences in the Alpine region. Although we are slightly above the level of the previous year overall, conditions vary significantly depending on the destination. Furthermore, the anticipation may be deceptive, as we experienced in the middle of the summer of 2023. The current low increase in price enforcement also worries me regarding covering the necessary cost structure. There is a risk that profit margins will shrink."

Matthias Trenkwalder, CEO of RateBoard, adds: "The booking forecast for the summer of 2024 in the Alpine region indicates an overall positive development and suggests good occupancy levels. In May, hoteliers reacted well to the high demand, attributed to the numerous holidays, by visibly increasing prices. This confidence in price enforcement would be desirable in the summer months as well, especially in regions with a good occupancy forecast."

For further information on the Summer 2024 Fact-Check,

Thomas Steiner, Managing Partner of Kohl > Partner, and Matthias Trenkwalder, CEO of

RateBoard, are available for inquiries.

https://lp.rateboard.io/hubfs/Banner_Blog%20Kohl_Partner_1200x630px%20%281%29.png

https://lp.rateboard.io/hubfs/Banner_Blog%20Kohl_Partner_1200x630px%20%281%29.png